Wednesday 2nd February 2022 at Unitarian Meeting Hall, Brunswick Sq

Present: Jo Plimmer (BCC Arts Team), Cllr Jude English, Jon Newey (Docklands), Lori Streich (CAG Chair), Cath (resident), Janine (Liaison Group), Jawahar (Liaison Group), Simon (Liaison Group), Prue (Liaison Group), Jo (resident), Karen (resident), Harvey (resident), David (resident), Julian (CAG Facilitator).

Jenny Gee from PG sent apologies.

Cultural Plan

Having a Cultural Plan for the site is a condition of the planning permission. It helps address concerns that a) the ground floor units could become dead space and ultimately revert to residential use and b) that the Carriageworks would turn its back (inadvertently) on St Pauls and become an island of gentrification. It is a unique document – few if any other examples of its kind.

Some years ago there was a lot of work on an outline Cultural Plan which has had some influence on the current document.

The Cultural Plan will be ‘owned’ by PG Group, the developer and owner of the site, and their successors.

The plan has four parts. The overarching document sets out the vision and objectives and also summarises the culture of the area. The Management Ethos Plan sets out the broad principles that will apply to management of the site. The Arts Plan sets out the strategy for public art on the site. The Community Benefits Plan sets out the opportunities for the local community to benefit from the Carriageworks in coming years.

The Cultural Plan Framework, submitted and approved in 2018, had a budget of £226,000 (cash and in-kind). In the current Cultural Plan document PG have allocated a budget of £80,000 to public art. Other items, including improvements to the market square to improve services for traders and potential use of a business unit, have not had a value attributed.

The purpose of the evening’s discussion was to gather ideas and thoughts on the potential community benefits from the Carriageworks development.

There are a number of opportunities including the market square, the market itself, a commercial unit potentially available for 3 years, apprenticeships with businesses, engagement with the local area etc.

Points made

- The market will have the potential to provide incubation space for new businesses

- There is a vibrant market for retail units on Stokes Croft. There is quite a high level of turnover and new businesses arriving

- The public have become accustomed to and want small startup independent traders (e.g. as seen at sites by the Harbour)

- There is and will be support for businesses from WECA and the Council in coming years.

- PG have made a commitment, through the Cultural Plan, to target “local independent businesses that will bring a vibrant use to the site”. However, there is a limit to how much the business occupiers can be controlled. Planning powers are restricted. Even the site owner would be unable to control business tenants’ companies being sold with resulting changes to ownership, independence and brands

- Carriageworks residents will be really important for defining what should and shouldn’t be done

- Securing community benefit will be hard work. Risk that PG, as a property developer, will take the path of least risk and least resistance.

Q&A

The answers below were contributed by everyone as part of the general discussion

Q: Could rents for businesses should be subsidised? A: This is not proposed by PG. Also, subsidising rents can be problematic as it is hard to know if the benefit is reaching those who most need it, or if it is simply increasing healthy profit margins for the business tenant. Also makes it harder for businesses to move on to units at market value. Can be better to focus on more tangible support and benefits.

Q: How will the market square be managed? A: The market square will be managed by BUOY Events, a Bristol based company that already manages the Harbourside market and other bespoke events. If we can identify organisations that would be interested in using the space that would be helpful. Agreed that direct conversation with BUOY would be really helpful. Events and non-market activities could make money and end up being cost neutral for the operator.

Q: Is there potential for market traders to get first refusal on available business units? A: There is nothing formal proposed but it is likely that the site owners / managers would naturally look to businesses they already know (e.g. who are trading on market stalls) when looking for tenants of any vacant business units.

Q: Can some of rent from the units go towards funding the cultural plan? A: Very unlikely that PG would agree to this. It would make management of the tenancies and the plan much more complicated and reduce the value of the investment. Could also turn into a levy on top of the business rents which could reduce demand for the units. It’s hard to make these businesses work anyway without adding to the pressure. A lot of the new developments in the area have ground floor commercial units – don’t want to make it harder for PG to attract tenants to the Carriageworks when there will be competing sites available.

Q. Will (some of) the market stalls have any prioritisation for local producers? A. Good point – should be achievable. A risk that without any prioritisation it will become a posh market for people who trade all over the place. Docklands prioritise suppliers within St Pauls and Dove St flats. Could be based on postcodes in the local area that have higher levels of disadvantage. Would need to be agreed with BUOY Events, the market operator.

Q. Could some market stalls be reserved for tiny operators at reduced cost for e.g. six months? A. Subsidy is not necessarily the solution. More about reaching potential traders in the right parts of the local area.

Q. Will there be apprenticeships e.g. at Bristol Loaf? A. Apprenticeships need to be with employers that young people are attracted to. Will a bakery appeal? Apprenticeships in creative industries is a possibility. PG needs to promote the apprenticeship idea and opportunity to incoming tenants. This would increase the social value of the development and could even form part of the public art package.

Q. If apprenticeships don’t work, could a lower level of opportunities be provided e.g. work experience, work with schools etc.? A. In practice anything with school age children can be very difficult to deliver so not easy to write into any agreements with tenants. But we can encourage it and point to the organisations that can help.

Business Unit

Q. What proposals exist for the potential business unit? Don’t want to lose the opportunity but do want to get a good use/occupier. A. It will need to be properly run, it will need staffing, are there organisations ready to step in and make something happen? Reference to the monthly Caribbean market at Kuumba with amazing creative people, half of whom are young. Could the business unit be a shopfront for local creative people as, for example, existed at Hamilton House? However, this was managed by someone (gets back to the need for a responsible organisation and staffing). Could it be a move on unit for successful market stalls to grow their business? Best solution would be for PG to issue a brief for the unit (setting out the physical spec, T&C of occupation and community benefit objectives) and ask for expressions of interest from local organisations. That will be the clearest way of finding genuine and viable interest. If no one comes forward then unit can be marketed to business occupiers – but rental income could be directed to community benefit in other forms.

Rising Arts Agency is a young people arts org, very talented, all under 25, very professional. They have a way of engaging with young people who need the opportunities to take them into the professional field. Have been based at Spike Island. Looking for commissions and for a new base. Having them at the Carriageworks in the business unit would create a huge social investment and impact.

Public Art Plan

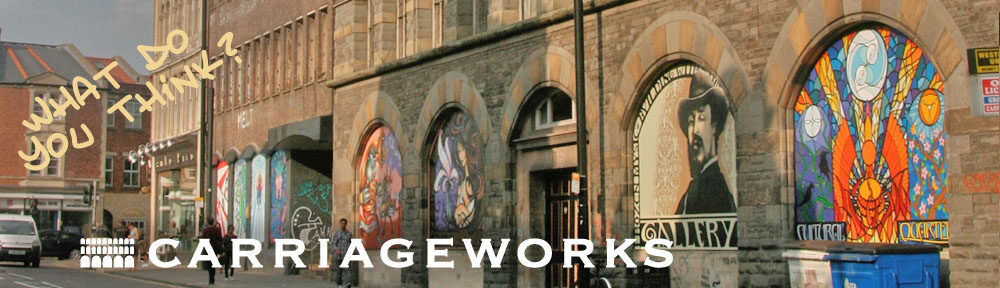

PG are proposing four parts of the buildings for murals. They need planning permission and want our support.

Points made

- Any public artist should work with young people

- Carriageworks has a shop unit and a £80k arts budget. Could just ask for something radical, different, that talks about the issues in Bristol. Maybe it’s murals but they have to mean something. Murals come and go. As a package the Rising Arts idea could be amazing – it’s the sort of thing that would win prizes

- Inky has been in touch. Carriageworks would be a wonderful site for this kind of thing; it would be transformative. He would provide a big name. Would not exclude work and opportunities for young people

- Bristol City Council arts team can make suggestions and encourage the developer to think widely. Murals and art commission are not the only possibility and often don’t make the most of the opportunity. Conversations with developers invariably start with a conversation about a statue – it’s the arts team’s role to get them to think more widely. This includes taking the local temperature

- The Cultural Plan is broader than public art and murals. We need to drive for something more

- Art is only good until it is tagged, and then you have to do something about it. There are better ways of spending £80k than on murals. Giving it to Rising Arts to develop art over x years would be better than spending it on murals

- Could public art makes the open spaces on the site more attractive – use it to improve the environment

- What is the public art brief? It must be written by someone who knows what they’re doing and not just focus on murals

- The process needs to be engaging

- We should not just support the easiest and quickest option. There needs to be a proper brief

- Don’t be prescriptive as to what the artist should do – they will bring different eyes and can astound

- There should be something to reflect Godwin – include this in the artist’s brief.

At the end of the discussion, and in the interests of clarity given that PG have asked for support, we voted on two approaches:

1: Support for PG to write a brief and commission murals on the walls: 1 vote

2. Support for PG to work with BCC and CAG on a brief for public art commissions that have real community benefit and may or may not include murals: 10 votes

CAG’s role is coming to an end. Question is; when CAG disappears is there an appetite for another group to continue overseeing the site.

CAG will be ending – what next?

If something is to take CAG’s place then people’s time has to be rewarded. We’ve given a huge amount over 11-20 years.

Commendations for the work of CAG – a huge achievement. PG have done well, CAG has done well. CAG should finish, have a party and let other people in the community pick it up.

People moving in should have a say in the future. We have a role in handover. Most important thing is to have a party!

Is part of the brief for whoever takes on the business unit to become the beginning of what is next and to engage with the community?

There are community groups popping up all over the city. CAG could relay 10 lessons it has learned.

The community input and involvement over the last 20 years could be recorded in the public art.

AOB

Q: Will it be gated community? A: Proposal for 11pm to 6am locked gates. That is different to a gated community. Young mothers with kids in the social housing – they are justified in wanting some security. The site would otherwise be at risk of ASB nightmares.